Coming to Grips with a Low Growth GDP Era

Let’s face it, we live in a low growth world. The days of 3% and 4% GDP growth rates are long gone. Most of the explanation is purely demographic. Low birth rates mean low workforce growth. Even more, greater portions of the population are spending on fixed budgets as waves of boomers turn 65.

So, when the U.S. reports a real GDP quarterly growth rate like last week’s +0.5%, the reactions are interesting. Here are some quick observations.

1. Low growth quarters like last week’s release are “Normal” by the statistical definition of the word.

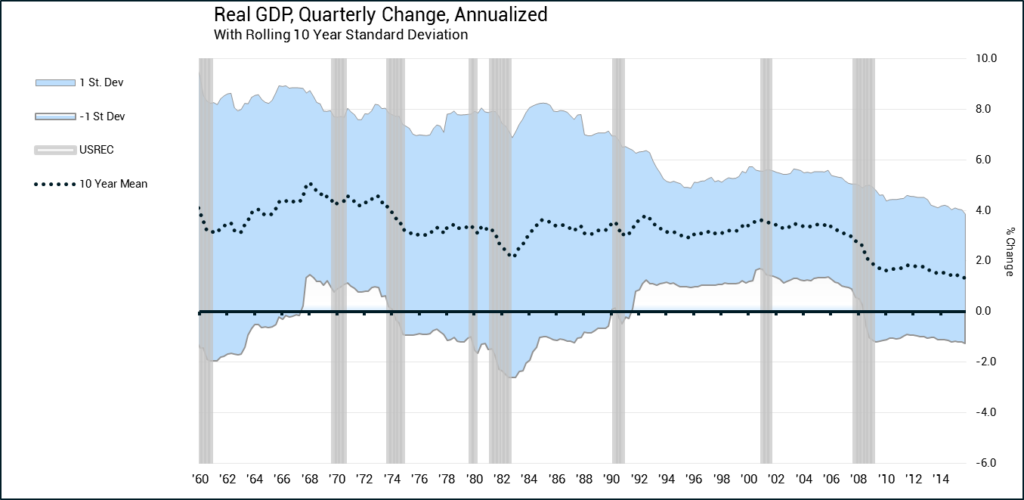

Chart 1 below shows the 10 year average of quarterly GDP growth wrapped by a one standard deviation metric in the shaded blue area. From a quick glance, one easily can see the longstanding run rate of 3%-4% growth from the 1960s to 2007. One can also see the downshift in average GDP after the last recession.

Take a deep look and one can see where the blue area has dipped below zero on the downside of the average. This conveys that sub 1% growth rates like the 1st quarter of 2016 fall well within the statistical boundaries of normal variance.

Chart 1

2. Sub 1% growth is no longer a bellwether signal that a recession is following.

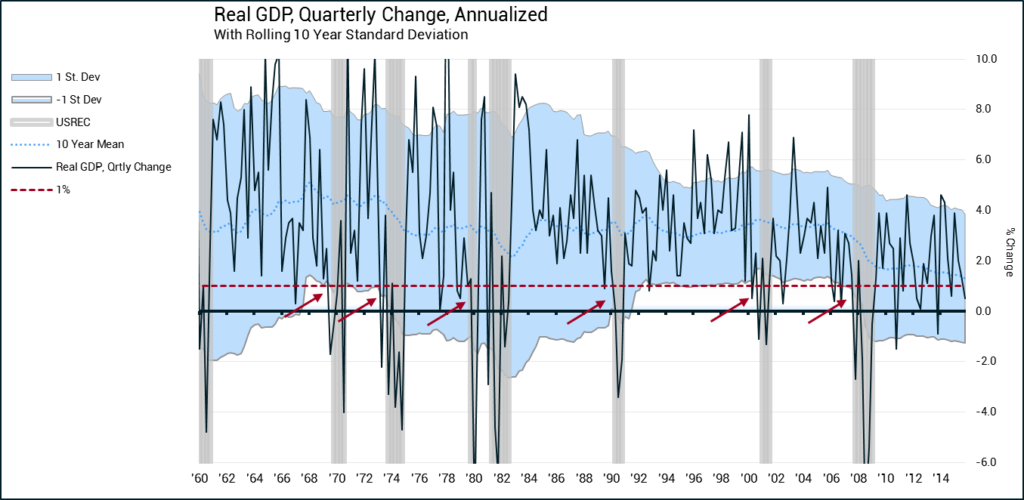

In prior decades, higher average growth rates meant that a low GDP quarter like last quarter likely foretold of an ominous end to the expansion. Chart 2 (below) layers actual quarterly GDP over the shaded area of normal distribution. For the most part, GDP growth stayed tremendously buoyant during expansions, rarely dropping below 1% growth.

In contrast, GDP prints at or below 1% typically preceded or coincided with recessionary starts.

Today’s low growth world is far different. If the current 1st quarter growth figure holds up after revisions, it would mark the seventh sub 1% growth quarter in the last 21 quarters.

Chart 2

In conclusion

I get it, it’s a common question, “How can markets keep going up when U.S. growth is so lousy?”

However, investors who get overly caught up on the structural issues of growth are missing the point.

It is not the rate of growth compared to prior decades that matters most, it is the resilient growth the U.S. is demonstrating compared to its weaker developed market peers.

Furthermore, as long as the growth ingredients remain intact – interest rates, low inflation, improving employment, capital investment – then growth will likely persist. And, in the end, the evidence remains clear: growing economies support expanding markets.

Christopher Riggs, J.D., CFP®, is the President of Alphalytics Research. To learn more about Alphalytics Research or the Economic Systemic Risk Index, please contact us at [email protected].