Preparing for a Market Recovery?

The History on Mid-Cycle Corrections

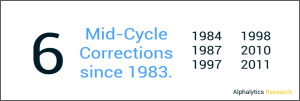

Since 1983, there have been a total of six “mid-cycle” corrections. The emphasis on “mid-cycle” is an important qualifier. It eliminates corrections occurring in the earliest stages of a fragile recovery and corrections occurring with late-stage economic exhaustion.

Since 1983, there have been a total of six “mid-cycle” corrections. The emphasis on “mid-cycle” is an important qualifier. It eliminates corrections occurring in the earliest stages of a fragile recovery and corrections occurring with late-stage economic exhaustion.

The most prominent lesson from these six is that they all had very attractive recoveries.

The most prominent lesson from these six is that they all had very attractive recoveries.

Just how attractive? Once a trough was established, the average twelve month return that followed was +29%.

If that average were to hold true in light of the recent correction, it means looking at an S&P 500® price target of 2,409 by next August 24th.

The Takeaway

In short, the core of the economy is still working quite well. Lending, cap-ex, manufacturing, and retail sales are all growing. Job growth is healthy and wages are increasing. Consumers have the greatest level of buying power seen in a very long while.

As the economy moves forward, bearish investors will have to rectify their positions with growing stock revenues well into 2016.