Announcing the Market Stability Monitor

Tracking Market Corrections

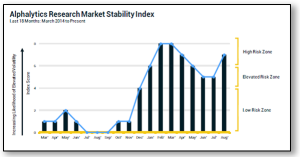

Alphalytics Research is pleased to announce our new monthly Market Stability Monitor. Subscribers are already familiar with the evidence-based approach to tracking the business cycle and evaluating recession risk. With this new report subscribers will now have access to a valuable resource for tracking and understanding the risk of a substantial equity market decline even when the economy is in an expansion.

“Most of the analysis around market corrections simply comes down to sentiment that ‘we’re due for one.’ Rarely do you see an analysis that quantifies risk and shows a historical track record. This is essentially what the Market Stability Index accomplishes,” cited Christopher Riggs, president and founder of Alphalytics Research.

What’s in the Index?

The Market Stability Index is based upon a “volatility of inputs” approach. Historically, market corrections have coincided with elevated volatility across market-shaping factors such as commodities, currencies, and rates.

“Intensive study of recessionary losses has allowed us to investigate what happens during market corrections – periods where the economy is intact, but yet a pullback of -10% or more occurs,” said Dean Harman, co-founder of Alphalytics Research.

“The evidence shows an interesting phenomenon. Equity volatility is never isolated. There are always precursors of dislocations across other factors. We can measure these, and, when there is a composite picture of factor disruption, equity market declines have historically followed,” adds Riggs.

Subscribers of the report will have access to:

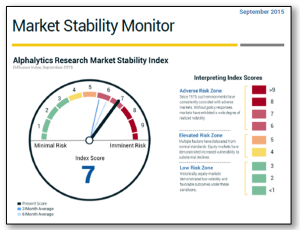

- The most current release of the Alphalytics Research Market Stability Index.

- A dedicated summary to help interpret the risk score.

- Further context for understanding the current correction risk environment.

This report is another of the latest enhancements to help professional investors reach better outcomes with evidence-based research.

For more information on obtaining a complimentary evaluation, please email us at [email protected].